IMPACT OF GST ON HOSPITALITY SECTOR

Contribution to India’s GDP

- Tourism in India accounts for 7.5 per cent of the GDP and is the third largest foreign exchange earner for the country.

- The tourism and hospitality sector’s direct contribution to GDP in 2016, is estimated to be US$47 billion.

- The direct contribution of travel and tourism to GDP is expected to grow at 7.2 per cent per annum, during 2015 – 25, with the contribution expected to reach US$160.2 billion by 2026.

GST on other hospitality services

- Bundled service by way of supply of food or any other article of human consumption or any drink , in a premises (including hotel, convention center, club, pandal , shamiana or any other place, specially arranged for organizing a function) together with renting of such premises--18% With Full ITC.

- Supply of tour operator’s services 5% No ITC

-

Restaurant owner can avail composition levy scheme if the aggregate Turnover in the preceding Financial Year is less than Rs. 50,00,000.(to be tax @ 2.5% CGST plus SGST (rate depending upon the state to state))

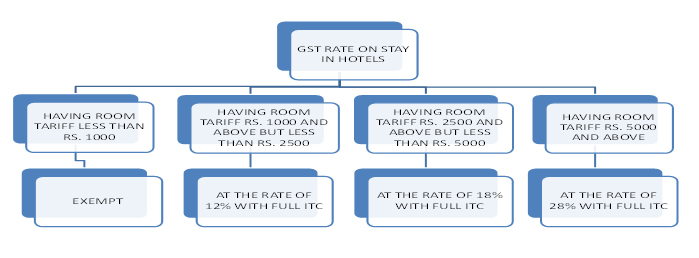

Impact of GST on stay in Hotels

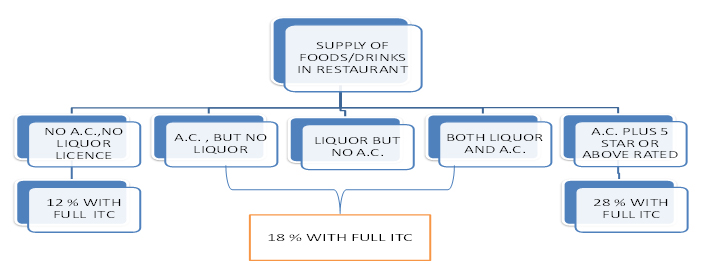

Impact of GST on Restaurant Facilities offered by Hotels

Benefits of GST are

Under GST, the largest benefit to hospitality industry are -

- Uniformity of tax rates and applicability of single rate.

- Better utilization of input credit and

- Benefits to end user in terms of lower prices.

Dis-advantages of GST are

Under GST, the largest dis-advantages to hospitality industry are -

- Possibility of Increased Cost.

- Increased cost affect competitions from Asian Markets.